Sorting out your finances after a heart attack

Explore how to manage your financial concerns after a heart attack.

Key takeaways

2 min read

About half of all heart attack patients worry about money during their recovery.

Insurance policies may be affected by your condition.

Financial assistance is available.

It’s common for people to worry about money after a heart attack. The costs can really add up, especially if you can’t work for a while. It’s also hard on pensioners and people without private health insurance.

If you’re having money worries, you’re not alone. Many other people are too. Your doctor or social worker will be able to tell you where you can get help or advice.

Health insurance and ambulance cover

Your health insurance will be affected by your heart attack. You may find that your premiums go up, or there may be some new terms. You may even have to have a medical check-up. This is because your heart attack means you now have a ‘pre-existing condition’. You’ll need to contact your health insurance provider to find out if there are any changes.

If you don’t have health insurance you can still get some, but there might be a waiting period. Talk to your doctor first.

It’s also a good idea to think about ambulance cover if your health insurance doesn’t include this. If you live in Queensland or Tasmania, there’s no need – everyone is automatically covered.

Income protection and life insurance

Life insurance and income protection insurance are still usually available to you too, but they might cost a bit more, or have a few more terms.

This will depend on things like:

Your family history

How severe your heart condition is

How well it’s controlled.

It might mean that you’re not covered for any future problems with your heart. It’s best to call them to check.

Benefits and financial support

If your heart condition means you can’t work or look after yourself, you may be able to get some financial support.

Here are some of the different supports available:

Sick leave through your employer.

Insurance and superannuation policies, which may cover some bills or replace some income.

Transport cover or subsidies through your hospital.

Mobility Allowance - check if you’re eligible.

Concessions, healthcare cards and benefits (like Sickness Allowance or the Disability Support Pension) can be arranged through Centrelink. Access to benefits depends on your finances, age, health and how long you’ve lived in Australia.

Emergency relief charities can help out with food, transport and vouchers. They can also help you with bills, or budgeting. Emergency relief is free, but you might have to qualify. There are many different providers who may be suitable for your needs.

Here are some other things you can do to save money:

Make sure your pharmacy has your Medicare number on file, so you’ll only be charged the Pharmaceutical Benefits Scheme (PBS) price. There’s a PBS Safety Net too, so once you’ve spent a certain amount on prescription medication (per calendar year), the rest is free or cheaper.

Have your medication reviewed to make sure you’re not buying things you no longer need. Your doctor or pharmacist can do this, or you can apply for a Home Medicines Review.

You can also save money at the pharmacy by buying cheaper generic brands and receiving subsidies. Just ask.

If you have debts, call the company you owe and explain the situation. Many companies have hardship officers who can help work out repayment plans.

If you need more financial advice, the MoneySmart website is a great resource.

You might also be interested in...

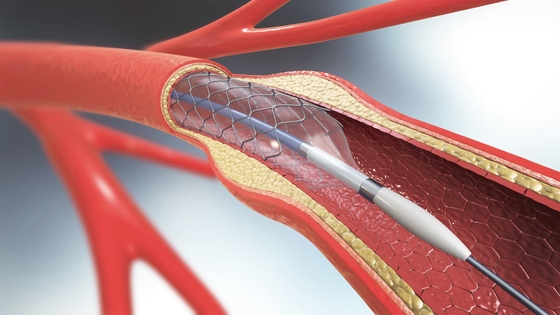

Heart procedures and devices

If you have a heart condition, your doctor may recommend different treatments, including procedures or devices.

Heart medicines – Frequently asked questions

Find answers below to frequently asked questions about heart medicines.

Returning to work after a heart attack

Discover how to plan for your return to work.

Last updated19 March 2024